New Framework Announced for Assessing and Reporting Nature-Related Financial Risks

While reporting of climate-related financial risks has dominated the news following the proposed rulemaking by the U.S. Securities and Exchange Commission (“SEC”), momentum is building toward a standardized reporting framework for sustainability disclosure related to companies’ interface with nature.

In November 2021, we spotlighted an increasing focus from investors and regulators on nature-related financial risks, explored the definitions and manifestations of those risks, and outlined the challenges and opportunities they may present for energy and infrastructure companies. In the months since, new developments have underscored a growing emphasis on biodiversity, including the release of an investor-focused framework for corporates and financial institutions to utilize when reporting nature-related risks, opportunities and targets. This framework could help to standardize reporting on risks related to nature, similar to the role played by the highly influential recommendations of the Task Force on Climate-related Financial Disclosures (“TCFD”).

Here, we provide background on the Taskforce on Nature-related Financial Disclosures (“TNFD”) and its relationship to other recent developments in sustainability disclosure, including additional initiatives emerging to help companies report their nature-related risks and impacts. We conclude with a brief look forward to the second session of the UN Biodiversity Conference (“COP15”) and other developments that could influence the future of nature-related reporting.

TNFD: A New Framework for Assessing Nature-Related Risk

On March 15, 2022, the TNFD, a UN-backed coalition of corporates, financial institutions and service providers, released a prototype framework designed to guide public and private companies and financial institutions through the process of assessing and communicating the financial stakes of nature loss. The three-part framework comprises investor-focused explanations of economic interdependencies on nature, a set of recommended disclosures, and a process for assessing nature-related risks and opportunities. The TNFD draft is designed to be compatible with existing corporate sustainability disclosure standards, a nod to the ongoing effort — led most notably by the IFRS Foundation’s International Sustainability Standards Board (“ISSB”) — to encourage global adoption of a consolidated set of standards.

The TNFD framework closely mirrors that of the TCFD, which is supported by more than 3,000 public and private organizations.1 The TCFD framework is already used by many corporates to voluntarily disclose climate risks, and it forms the basis of the SEC’s proposed climate disclosure rule,2 as well as other regulatory and voluntary disclosure frameworks, including the one being crafted by the ISSB.3

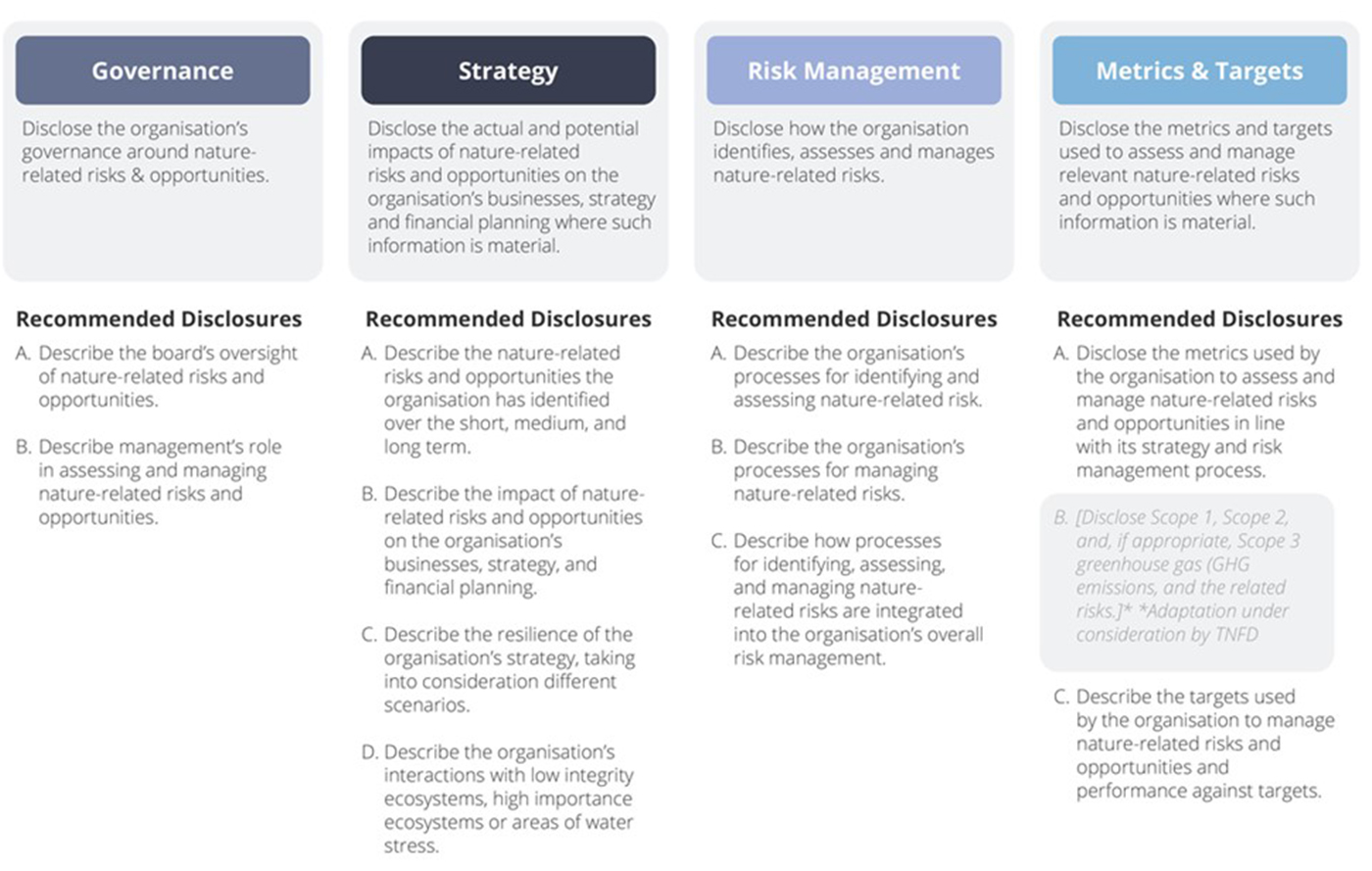

Following the TCFD’s four reporting pillars, the TNFD recommends companies undertake 11 core disclosures, highlighted below.

The TNFD’s four pillars of disclosure, from the Nature-related Risk & Opportunity Management and Disclosure Framework

The TNFD’s four pillars of disclosure, from the Nature-related Risk & Opportunity Management and Disclosure Framework

To assist companies with such disclosure, the TNFD framework includes an integrated analytical approach to assessing nature-related risks and opportunities on an iterative basis, called LEAP. LEAP instructs companies to:

- Locate the biomes and ecosystems in which they have physical assets and operations and related value chain activities;

- Evaluate whether such assets, operations or value chain activities are located in “priority” areas of high biological or water stress, and what dependencies those assets have on surrounding ecosystems;

- Assess how changes to natural resource supplies may pose risks to the company and what steps can be taken to mitigate those risks; and

- Disclose such risks and plans to relevant stakeholders.

Consideration of location is of particular importance to the proposed framework, as nature-related dependencies and impacts — the sources of risks to business continuity, earnings and ultimately enterprise value — can be location-specific. This approach is similar to the environmental impact reviews associated with major energy and infrastructure projects in the U.S., such as those requiring federal agency discretionary approvals triggering the National Environmental Policy Act (“NEPA”). However, the TNFD framework employs a broader scope; it encourages organizations to report these types of risks on an enterprise level rather than project-by-project, which is unprecedented in the U.S. The TNFD also suggests that, after no more than five years, organizations should be accounting for their full set of material nature-related dependencies and impacts across their upstream and downstream operations when making disclosures.4

The TNFD’s prototype now enters an 18-month consultation period, expected to culminate in the release of a final framework in September 2023. The TNFD’s interactive platform will be available for testing throughout the intervening months, and stakeholders are encouraged to provide feedback on its recommendations.

Global Support for Nature-Related Disclosures

Other developments since our November blog post underscore natural capital’s rising prominence on 2022’s investor agenda. For example, a March study found that 41% of institutional investors name biodiversity as a significant factor in their investment policy — more than double the proportion in 2020. Several large financial institutions are supporting the development of the TNFD framework, and the number of investors signing the Finance for Biodiversity Pledge has continued to grow; signatories now comprise 89 financial institutions with more than $14 trillion in assets. Additionally, Nature Action 100, a collaborative engagement initiative for institutional investors to engage with companies and policymakers on nature-related issues, analogous to Climate Action 100+, is expected to launch this summer. These and other similar developments could strengthen market support for the adoption of the TNFD’s framework in the coming months.

Complementary Nature-Related Reporting Standards

The TNFD’s recommended disclosures notably lack guidance on the specific metrics and targets that organizations should use in their planning and reporting.5 This omission likely stems from the relative lack of market or regulatory consensus around an architecture of metrics for nature protection and restoration, as well as the inherent difficulties in quantifying nature-related risks. Energy and infrastructure companies with large physical assets and operational footprints across many ecosystems and jurisdictions may find it particularly difficult to determine which metrics are most useful in assessing nature-related risks to their business.

To navigate this ambiguity, several organizations have recently announced projects aimed at standardizing the technical details of nature-related disclosures. These include:

- The November 2021 release of guidance for biodiversity-related disclosures from the Climate Disclosure Standards Board (“CDSB”), a standard-setting body focused on mainstreaming environmental and social reporting, whose disclosure frameworks — including previous guidance on water disclosures — are referenced as potential supplemental disclosures to the ISSB’s core framework;

- Widely used reporting platform CDP’s inclusion of six biodiversity-related questions in its 2022 climate change questionnaire for corporates;

- The Science-Based Targets Network’s plan to finalize methodologies and tools for assessing nature-related dependencies and impacts and setting corporate targets related to natural capital — complementing the Science-Based Targets Initiative’s science-based climate targets — by the end of 2022;

- An announced collaboration on April 5 between the UN Environmental Program Finance Initiative and the Finance for Biodiversity Foundation to develop a suite of biodiversity targets and metrics for financial institutions’ portfolios, due in 2023; and

- The European Financial Reporting Advisory Group (“EFRAG”) and the widely used sustainability standards setter Global Reporting Initiative (“GRI”) announcing the co-development of biodiversity-related disclosure standards, due in the second half of 2022.

Looking Ahead

In the months ahead, as ESG reporting standards continue to evolve and potentially converge, the TNFD framework will be refined to maximize its relevancy to reporting companies’ stakeholders. The TNFD has signaled that it will consider including in its framework any nature-related metrics and targets set out in the Post-2020 Global Biodiversity Framework, which is expected to be adopted at the second session of COP15, which has been delayed to the third quarter of this year.

In the meantime, three reporting regimes may provide an opportunity for organizations to test the TNFD’s draft framework and could, along with COP15, influence its trajectory and the trajectory of the complementary standards discussed above.

First, the ISSB’s recent draft of General Requirements for Sustainability Disclosures indicates that organizations voluntarily reporting in line with the ISSB’s standards should assess all sustainability-related risks and opportunities that may be financially material, explicitly mentioning the CDSB’s guidance for assessing biodiversity- and water-related impacts and dependencies as tools that organizations may look to in evaluating materiality.

Second, asset managers and financial institutions required to conduct Principal Adverse Impact reporting under the European Union’s Sustainable Finance Disclosure Regulation (“SFDR”) will be required to disclose the share of their investments in investee companies with sites or operations located in or near and negatively affecting biodiversity-sensitive areas, as well as the extent to which the disclosing entity’s investments contribute to the protection of global biodiversity, from January 1, 2023.6 Companies in which these financial actors invest may be pressured to disclose their nature-related risks and impacts, even if not explicitly required to do so, as certain nature-focused investors and lenders push for greater transparency around how their portfolios could impact global biodiversity.

Third, the draft EU Sustainability Reporting Standards (“ESRS”), developed by EFRAG and released on April 29, 2022, include specific guidelines for biodiversity- and ecosystem-related corporate disclosures. The ESRS biodiversity and ecosystems standard would require companies to disclose their targets, plans, policies, performance metrics and strategies related to both their impacts from and positive and negative impacts on nature, following EFRAG’s focus on double materiality. The draft ESRS standards, which are open for consultation until August 8, 2022, will apply to companies exceeding a certain capital and labor force limits7 under the EU’s proposed Corporate Sustainability Reporting Directive (“CSRD”).

In light of these developments, energy and infrastructure companies developing their climate and ESG strategies may wish to include an assessment of the dependency and resilience of their businesses relative to global natural capital as part of that process.

We will continue to monitor developments with respect to the TNFD and biodiversity risk disclosure more broadly, and we intend to provide further updates on this topic after the second session of COP15. We continue to encourage energy and infrastructure companies to consider the steps outlined in our November blog post for navigating the changing landscape with respect to biodiversity and nature related risks and opportunities.

1. We discuss the TCFD’s most recent annual report and updates to its guidance in our November 2021 Alert, “TCFD Issues New Guidance as Its Climate Reporting Framework Continues to Gain Traction.”↩

2. We provide an overview of the SEC’s proposed climate disclosure rule and its implications in our March 2022 Alert, “SEC Proposes New Climate Disclosure Requirements.”↩

3. We explore the architecture and implications of the ISSB’s draft standards in our May 2022 Alert, “ISSB’s Proposed Framework Seeks to Unify Global Sustainability Disclosure Standards.”↩

4. This proposed timeline aligns with TCFD’s concept of a five-year pathway to full disclosure.↩

5. The TNFD is currently considering what nature-related data, metrics and targets are relevant to the proposed framework’s core concepts and definitions, especially relating to environmental assets, ecosystem services, impact drivers and impacts.↩

6. One of the SFDR’s 18 mandatory Principle Adverse Impact disclosures is “share of investments in investee companies with sites/operations located in or near to biodiversity-sensitive areas where activities of those investee companies negatively affect those areas.”↩

7. The CSRD will capture those entities that are already captured by the Non-Financial Reporting Directive and will also capture companies that meet two of the following three criteria: (i) over €40 million in net turnover, (ii) over €20 million in assets, or (iii) an average of 250 or more employees. From January 1, 2026, small- and medium-sized enterprises will also be captured by the CSRD.↩

- Read all insights from the Energy & Infrastructure Blog.

- Read more ESG & Impact insights.

- Subscribe to receive future updates.

This publication may cite to published materials from third parties that have already been placed on the public record. The citation to such previously published material, including by use of “hyperlinks,” is not, in any way, an endorsement or adoption of these third-party statements by Kirkland & Ellis LLP.