7 Steps for Managing Private Equity Whistleblower Risk

On Nov. 15, the U.S. Securities and Exchange Commission released its 2019 annual report to Congress on its whistleblower program.[1] Since 2012, the SEC has paid 67 whistleblowers approximately $387 million.[2] In 2019, eight whistleblowers received about $60 million.[3]

The payout is down somewhat this year. Awards in 2018 alone reached $146.8 million, more than all past awards combined.[4] Tips to the SEC were the highest ever in 2018, with the highest annual increase in tips ever, reaching nearly 5,200 reported to the commission.[5]

Increased tipping that year was likely due to a U.S. Supreme Court precedent set at the end of 2017. In Digital Realty Trust Inc. v. Somers, the court unanimously ruled that protection from retaliation under the Dodd-Frank Wall Street Reform and Consumer Protection Act does not extend to whistleblowers that do not report to the commission.[6]

There may have been a bump in tips in 2018 if Digital Realty spurred tipsters who had already reported internally, believing their actions to be protected from retaliation, to subsequently report the matter to the SEC in order to receive protection.

If true, then 2019’s tip decrease could reflect an overall decrease in internally reported issues as well. Potential whistleblowers may prefer to primarily report internally, and with new clarity that such reports are not protected under Dodd-Frank, potential tipsters may have stayed mum.

Seven of the eight 2019 recipients reported their concerns internally to their company as well as to the SEC. [7] Despite the lack of retaliation protection and financial incentive, 85% of whistleblower tips from current or former employees in 2019 were reported internally before they were reported to the SEC.[8]

Internal reporting presents a real opportunity for companies to investigate the issue internally and prepare for a possible future government investigation. Creating a culture that encourages internal reporting is now more critical than ever.

Following recommendations from the SEC’s Office of the Whistleblower,[9] Congress may eventually add anti-retaliation protections for whistleblowers that report only internally,[10] although the process would take years.

Private Equity Risk

Private equity firms face unique risk when handling tipping and whistleblowers. While most are not publicly traded companies with public reporting obligations, they are typically registered as investment advisers subject to general SEC oversight and inspection, meaning they can be more vulnerable to an inspection or examination from a tip spurred by a whistleblower.

They also are in the business of buying and selling portfolio companies, which are themselves subject to various whistleblower risks. In addition to any of the underlying conduct and attendant whistleblower risks that may affect the value of their portfolio companies, private equity firms that take control positions in portfolio companies could have exposure to liability deriving from whistleblower related misconduct occurring at their portfolio companies.

Private equity firms benefit from developing and implementing strong reporting and compliance procedures in their own firms and their portfolio companies to create a culture of regulatory compliance and protect portfolio assets.

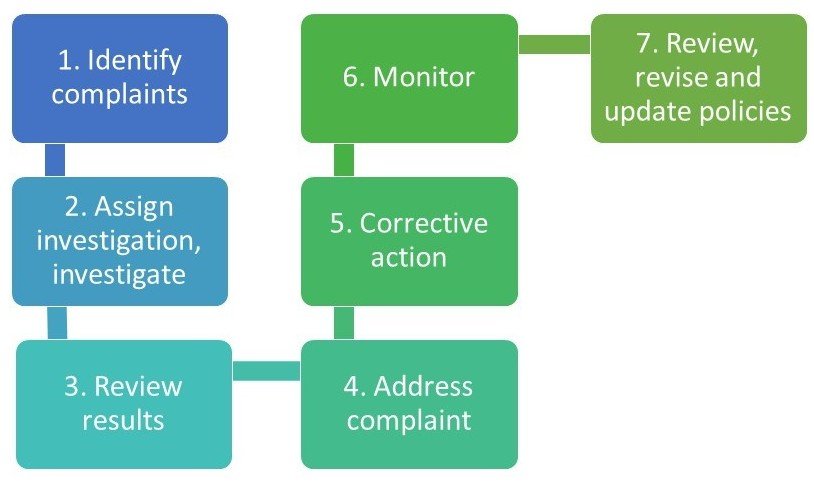

Executive Summary: How To Conduct an Internal Investigation in Seven Steps

1. Create a culture that makes it easy to identify complaints.

Creating a culture that encourages internal reporting enables firms to identify and address issues internally and at their portfolio companies before they escalate.

Whistleblower procedures that include anonymous tip lines provide avenues for employees of the firm and their portfolio companies to report concerns without fear of retaliation. Firm managers should highlight these reporting lines, anti-retaliation policies and dedication to compliance.

Training on handling complaints is also critical to developing a culture of compliance. Complaints may not obviously relate to whistleblower issues when they first appear internally. Appropriate identification aids fruitful internal investigations. Firms should be aware that a wide variety of internal complaints could ultimately become whistleblower reports.

Some complaints obviously merit internal investigation, for example, complaints about financial misconduct, violating compliance rules and suspicious trading. Cybersecurity has also recently received heightened attention from regulators.

However, complaints about inappropriate conduct, such as discrimination, bullying and so-called #MeToo behavior, should also feed into a robust internal investigation and compliance program.

2. Assign the investigation and investigate.

Take steps to preserve confidentiality of the complaint and complainant without impeding their ability to exercise their right to report to the government. Firms should keep in mind that they cannot stop employees from reporting concerns to the government. They should review their internal compliance manual and policies to ensure those documents do not imply that employees cannot report problematic behavior to the government.

Assigning the investigation to an attorney, either outside counsel or in-house counsel, early in the process can assist with making sure the firm does not inadvertently take any actions against the reporting employee that may later be deemed to be retaliatory.

Being aware of the risks at the outset of an investigation can mitigate the risks of accidental retaliation over the course of resolving the issues.

3. Review the results of the investigation.

Identify the issue underlying the complaint and confer with counsel. It is important to work with counsel to understand the nature and scope of the problem, including any violations of the law, and possible exposure as a result.

4. Address the complaint and avoid retaliation.

When considering strategies to address issues identified in the internal investigation, ensure that the resolution is not retaliatory against the whistleblower. Whistleblowers should be treated consistently with other employees.

It is also important to limit the number of people who are aware of the report and investigation in order to monitor retaliation from others who may be aware of any complaint. Retaliation by anyone at the firm, whether it is by senior management or otherwise, can be imputed to the firm directly.

5. Implement necessary corrective action.

Firms should consider documenting changes made in response to whistleblower complaints in a manner that is appropriate for sharing with the government during a compliance examination.

Attempt to avoid including privileged information in any documentation that you may later wish to share with the government, but provide enough information to illustrate the actions taken to investigate the whistleblower's concerns and implement any necessary corrective action.

It is a good practice to review documentation with counsel to confirm it protects confidentiality, while addressing the issues that may be of concern to a potential examiner.

6. Monitor the situation.

Monitor the issue underlying the original complaint to see whether the issue reoccurs. Make adjustments if the problem continues, with the help of counsel.

Also, monitor for retaliation against the whistleblower. Retaliation may occur on a longer time horizon than the responsive action, and may include improper allocation of assignments or duties, limited advancement or denial of leave.

7. Review documented processes and procedures and see if they need to be updated.

Compliance problems can occur when the underlying policies are not clear. The incident, even if it warranted investigation from the government, may not have clearly violated policies.

Were the policies too vague in application? Had significant changes to practices or the law occurred since their last update? Review, revise and update policies as needed.

Conclusion

Whistleblower reports to the commission increased in 2018 after Digital Realty, hitting an all-time high. The number of reports decreased in 2019.

Congress may take action to increase protections of whistleblowers soon, but in the meantime it is a good practice to create a culture that discourages retaliation and encourages internal reporting.

Proper whistleblower response procedures can help address issues before they escalate, and leave firms stronger, with better compliance policies as a result.

Consult in-house or outside counsel to maintain confidentiality, avoid retaliation and address underlying problems during internal investigations of internal complaints and issues.

Erica Williams and Alpa Patel are partners, and Rachel Hansen is an associate at Kirkland & Ellis LLP.

The opinions expressed are those of the author(s) and do not necessarily reflect the views of the firm, its clients, or Portfolio Media Inc., or any of its or their respective affiliates. This article is for general information purposes and is not intended to be and should not be taken as legal advice.

[1] 2019 SEC Whistleblower Report, available at https://www.sec.gov/files/OW_2019AR_FINAL_1.pdf.

[2] 2019 Report at 1.

[3] Id.

[4] Office of the Whistlebower, Previous News and Releases, https://www.sec.gov/whistleblower/pressreleases.

[5] Jane Norberg, Chief, Office of the Whistleblower, 2018 Annual Report to Congress, Message from the Chief, p. 2, available at https://www.sec.gov/sec-2018-annual-report-whistleblower-program.pdf (hereinafter “2018 Whistleblower Report”).

[6] Digital Realty Trust Inc. v. Somers , 583 U.S.. ___ (2017).

[7] 2019 Report at 2.

[8] 2019 Report at 18.

[9] See 2019 Report.

[10] The Whistleblower Programs Improvement Act, S. 2529, was introduced by Senators Baldwin, Durbin, Ernst and Grassley on Sept. 24, 2019, and the House enacted the similar Whistleblower Protection Reform Act of 2019 (H.R. 2515) by an overwhelming, bipartisan majority of 410-12 in July, 2019.