Cos. Must Prepare For Emerging ESG Risks In Supply Chains

In this article for Law360, partner Sara Orr and associate Jacqueline Yap discuss recent ESG-related developments impacting supply chain development in the U.S.

Supply chain risks are a major focus of investors and companies in light of the Russian invasion of Ukraine, the COVID-19 pandemic and climate change.

Only a handful of countries currently regulate the disclosure of supply chain impacts on the environment and society, but high-profile claims of human rights violations in the Xinjiang region of China and elsewhere have spurred legislators in the U.S. to take action.

This post summarizes three recent legislative developments in the U.S. affecting corporate supply chain management.

ESG and Supply Chains

Stakeholder focus on environmental, social and governance, or ESG, issues is pushing companies to increase transparency and accountability within their supply chains.

ESG topics relevant to a company's supply chain are varied, and may include human rights, forced labor, greenhouse gas emissions and biodiversity loss.

Supply chain management typically involves a network of individuals, organizations, resources, activities and technology that cover product development, sourcing, production, procurement, logistics and operations within the corporate supply chain — defined as the entire system of producing and delivering a product or service, from the very beginning stage of sourcing raw materials to final delivery of the product or service to end users.

Supply chain management typically sits within the manufacturing or operations divisions of corporations, and may be overseen by the chief procurement officer, chief logistics officer, supply chain manager and/or operations managers.

Legal oversight of supply chain management is now coming to the fore as regulators increasingly focus on ESG impacts within the corporate value chain.

Many U.S. companies elect to voluntarily disclose their efforts to evaluate suppliers and monitor their performance in relation to various ESG topics, but there is no comprehensive U.S. legal requirement to do so.

For example, corporate supplier codes of conduct are often published on company websites, in addition to stand-alone ESG reports or human rights policies or reports, all of which may disclose supply chain risk management efforts.

Many companies also compete for high scores from various third-party ESG ratings agencies, and voluntary benchmarks, such as the Corporate Human Rights Benchmark, Transparency International or KnowTheChain.

Since 2012, the U.S. Securities and Exchange Commission has required U.S. public companies to disclose whether they use certain minerals sourced in the Democratic Republic of Congo or an adjoining country,[1] in Title 17 of the Code of Federal Regulations, Parts 240 and 249b, which require conducting supply chain due diligence.

The SEC is co-leading a technical expert group within the International Organization of Securities Commissions that is advising on the climate and ESG disclosure frameworks being developed by the International Sustainability Standards Board in an effort to harmonize corporate disclosures.

In the interim, the SEC is taking a piecemeal rulemaking approach to ESG disclosure, with particular focus on climate change, human capital management and cybersecurity disclosures.

Companies with global operations must navigate a range of overlapping regulations and norms in countries more advanced in ESG regulation than the U.S.

For example, the Europe Commission has recently proposed a long-awaited corporate sustainability due diligence directive to implement a sustainability due diligence strategy addressing adverse human rights and environmental impacts across companies' global value chains.

Three Recent U.S. Legislative Developments

Recent legislative developments in the U.S. heighten the importance of developing and maintaining robust corporate supply chain management systems.

Three noteworthy developments related to goods sourced from the Xinjiang region of China, greenhouse gas emissions and regulation of the fashion industry are discussed below.

Uyghur Forced Labor Prevention Act: Human Rights in Supply Chain

In recent years, the global spotlight on human rights issues has focused on forced labor camps within the Xinjiang Uyghur Autonomous Region of China.

Taking a historic step toward regulating human rights impacts within corporate supply chains, the U.S. enacted the Uyghur Forced Labor Prevention Act in December 2021, effective on June 21, 2022.

The UFLPA creates a rebuttable presumption that all goods mined, produced or manufactured wholly or in part within the Xinjiang Uyghur Autonomous Region were produced with forced or compulsory labor. The act prohibits the importation of such goods, unless U.S. importers can demonstrate they have conducted adequate supply chain due diligence to confirm downstream products were not so produced.

This law will primarily affect goods such as cotton, tomatoes and polysilicon production, thereby having a specific impact on the solar, fashion, and food and beverage industries.

The Forced Labor Enforcement Task Force[2] sought public comments on additional due diligence guidance and high-priority areas of enforcement by March 10, and will be conducting a public hearing within 45 days, by April 25, which could expand the scope of the task force's enforcement of the UFLPA.

Continued monitoring of the due diligence guidance and enforcement risks will be important to identify regulatory requirements around demonstrating adequate corporate supply chain due diligence, and could serve as a model for future regulation around other types of imports, including, for example, those connected to Russia.

Disclosure of Greenhouse Gas Emissions Within Supply Chains

Many companies, particularly in the energy and infrastructure industry, have focused on voluntarily measuring and managing Scope 1 and 2 greenhouse gas emissions from their own operations, and electricity and heat consumption, respectively.

However, market and regulatory pressures are driving companies to also measure and manage their Scope 3 emissions, which are a company's indirect emissions, not included in Scope 2, that occur in its value chain, including both upstream and downstream emissions — i.e., supply chain and customer use — if deemed material to investors.

In addition to the SEC's newly proposed climate-related disclosure rule requiring public companies to disclose their Scope 1, 2 and, in some cases, Scope 3 emissions, the California Legislature is considering a bill that would require such disclosure for large companies operating in the state, which, if passed, would add another lever to the continued push to assess ESG risks within the corporate supply chain.

New York Efforts to Increase Supply Chain Transparency in Fashion

New York state legislators proposed the Fashion Sustainability and Social Accountability Act in October 2021.

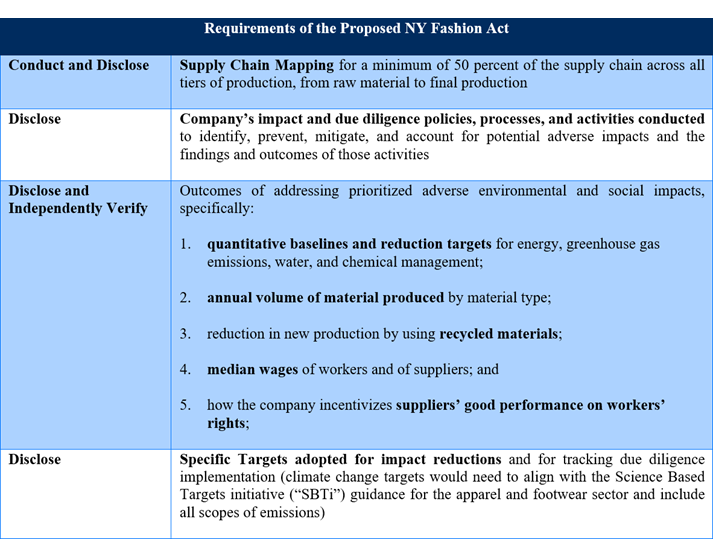

If passed, the act would require fashion retail sellers and manufacturers with more than $100 million in revenue conducting business in New York to disclose their environmental and social due diligence policies, processes and outcomes, including significant real or potential adverse environmental and social impacts, and disclose targets for prevention and improvement.

Under the proposed act, failure to comply may lead to civil liability and result in fines of up to 2% in annual revenues, provided they exceed $450 million.

If passed, the law could have knock-on effects on the myriad suppliers in the fashion value chain, including energy, agriculture and other companies that provide the raw materials for certain synthetic fabrics.

The proposed legislation also provides a helpful blueprint as to where the winds of mandatory ESG diligence and disclosure may blow in the coming years for companies across sectors.

It would mark the first time in the U.S. that diligence and robust disclosure of ESG issues in an entire sector's supply chains would be legally required.

What Companies Can Do Now to Prepare

Companies may consider taking the following actions in response to current and anticipated future regulation of ESG risks in supply chains.

Integrate legal, sustainability and supply chain management.

There is no one-size-fits-all approach to ESG risk mitigation.

With respect to supply chain issues, in-house counsel will need to work closely with operations and various other business units to design a system that produces the data needed to demonstrate compliance with law, mitigate reputational and operational risks, and meet investor and customer needs.

For example, significant supply chain diligence and documentation obligations are expected for U.S. companies importing cotton, tomatoes and polysilicon from China, so if such goods are part of the corporate supply chain, developing compliant due diligence processes will be a top priority.

Update ESG and supply chain due diligence policies and procedures.

With the increased focus on ESG and supply chains, it may be helpful to refresh or develop robust due diligence policies and procedures.

As with all things ESG, there will be an element of prioritizing the highest areas of risk and focusing initiatives around the mitigation of those risks.

In addition to ensuring compliance with applicable legal requirements affecting supply chain management, such as the California Transparency in Supply Chains Act and the U.K. Modern Slavery Act, companies can elect to follow one or more voluntary ESG supply chain frameworks to serve as a guide while legislation crystallizes.

Voluntary frameworks include the United Nations' Guiding Principles on Business and Human Rights, the Organization for Economic Co-operation and Development Guidelines for Multinational Enterprises and the OECD Due Diligence Guidance for Responsible Business Conduct.

It will be important to take a holistic view of the company's industry, geographic footprint, turnover, stock exchange listing and key stakeholders to ensure the due diligence policies and procedures are carefully tailored to the company's specific supply chain, voluntary ESG commitments, and applicable regulatory and industry standards.

Evaluate and update ESG reporting.

A majority of U.S. public companies disclose ESG information, including in relevant securities filings, stand-alone ESG reports and/or on company websites.

Existing or new ESG disclosures should take into account applicable supply chain management obligations, including existing or proposed legislation, along with broader market trends related to improved transparency to key investors, customers and other stakeholders.

All public disclosure, including data and communications around ESG risks and supply chain management, should be rigorously reviewed with the appropriate internal disclosure controls to avoid any risks of greenwashing.

Sara Orr is a partner and Jacqueline Yap is an associate at Kirkland & Ellis LLP.

The opinions expressed are those of the author(s) and do not necessarily reflect the views of the firm, its clients, or Portfolio Media Inc., or any of its or their respective affiliates. This article is for general information purposes and is not intended to be and should not be taken as legal advice.

[1] Adjoining countries include Angola, Burundi, Central African Republic, the Republic of the Congo, Rwanda, South Sudan, Tanzania, Uganda, and Zambia.

[2] The Forced Labor Enforcement Task Force is an organization established under the United States-Mexico-Canada Agreement in 2020 to monitor and coordinate United States enforcement of the prohibition of forced labor imports under section 307 of the Tariff Act of 1930 across federal government agencies.