Midstream REIT Guidance Creates Opportunities for Midstream Oil & Gas

Thanks to recent IRS guidance, investors may now be able to hold certain midstream oil and gas assets in a tax-efficient real estate investment trust ("REIT").

Background: Historic Structures and REIT Benefits

Prior to the energy market dislocations of the past six years, the Master Limited Partnership ("MLP") was the vehicle of choice for publicly traded midstream companies. However, the total market capitalization invested through public MLPs has plummeted from more than $600 billion in 2012 to $288 billion in late 2019. A variety of factors have led investors to become more wary of the MLP as an option for monetizing midstream assets, such as the general investor pullback from the public energy markets, the tax reform passed by Congress in 2017 (which narrowed the difference in effective tax rates for investments in public corporations versus MLPs) and retail investor preferences for IRS Forms 1099 from a corporation or REIT over Schedule K-1 from an MLP.

REITs have many advantages as a vehicle for investing in the midstream oil and gas space — a REIT is a tax-efficient investment vehicle that facilitates capital accumulation and deployment for a wide variety of investor constituencies. A REIT has the unique ability to function as a blocker corporation while still maintaining some flow-through benefits and avoiding entity level corporate tax. This makes the REIT highly attractive to tax-exempt investors sensitive to unrelated business taxable income and to non-U.S. investors sensitive to income effectively connected with the conduct of a U.S. trade or business (and in some cases, to capital gains taxed under the Foreign Investment in Real Property Tax Act ("FIRPTA") rules as well). REITs are also appealing to U.S. individuals and other retail investors because of their streamlined reporting and administration requirements compared to MLPs and other pass-through structures (such as 1099 reporting and certain state tax benefits).

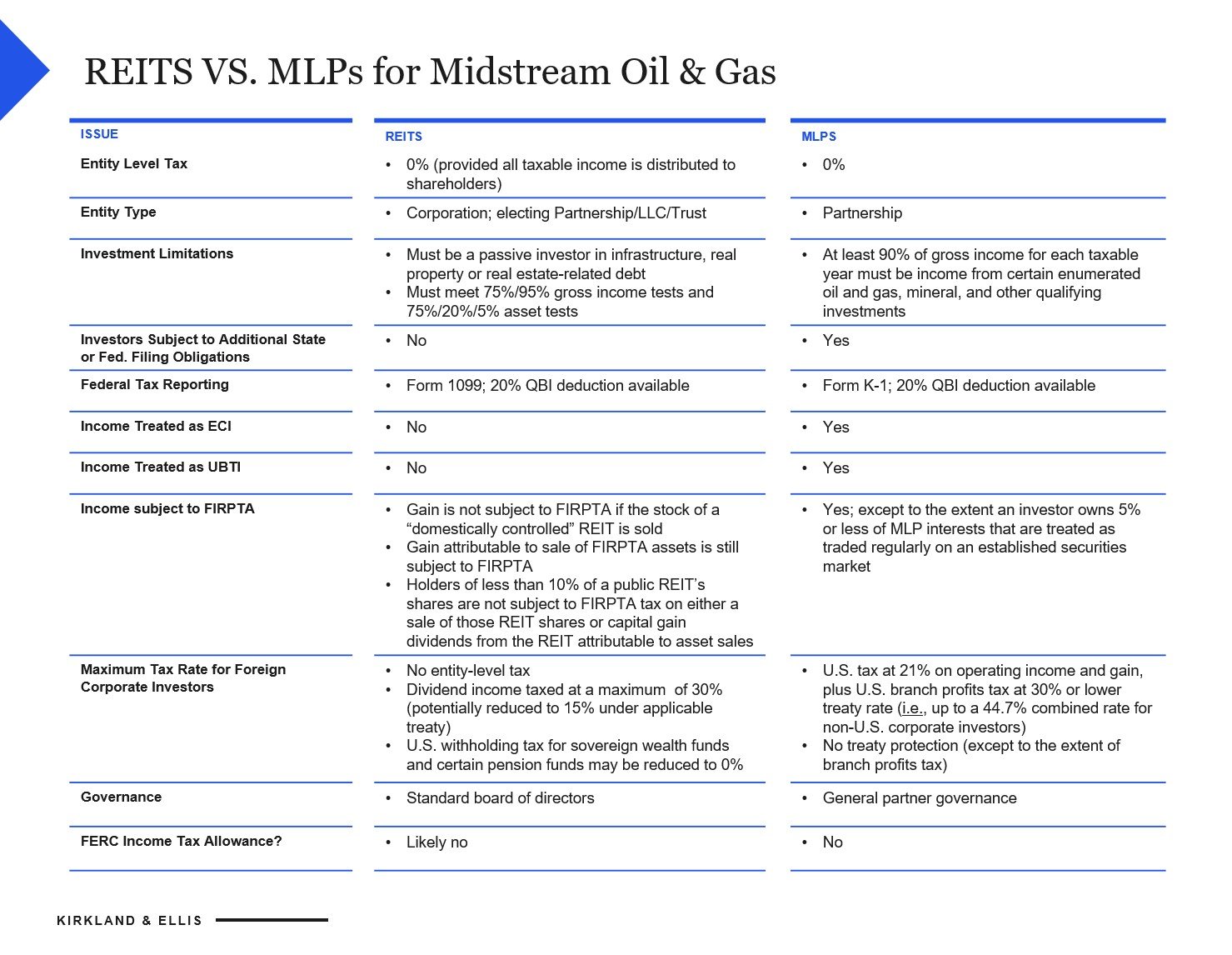

The following chart highlights some of these benefits:

The Midstream REIT Ruling

Historically, midstream and upstream energy assets were off-limits for REITs, as REIT investments are required to meet complicated tests regarding asset and income composition, and the REIT must limit services provided to certain “permissible” services. Among other requirements, more than 75% of a REIT’s income must come from “rents” from real property in the form of leases or other real-estate related passive income, not service contracts or other active revenue streams. Owners of assets that generated “active” income such as a pipeline or energy storage facility could still satisfy the REIT rules by triple-net leasing the assets to an operator, but most midstream asset owners do not triple-net lease their assets.

The guidance issued by the IRS in February 2019 expanded permissible passive income under the REIT rules by treating income from industry-standard midstream contracts (including payments by customers for the use of pipeline or storage capacity) as “rents” for REIT purposes. The ruling also expands the scope of “permissible” services a REIT could perform with respect to midstream energy assets without compromising its REIT status, including certain maintenance, security and inspection services.

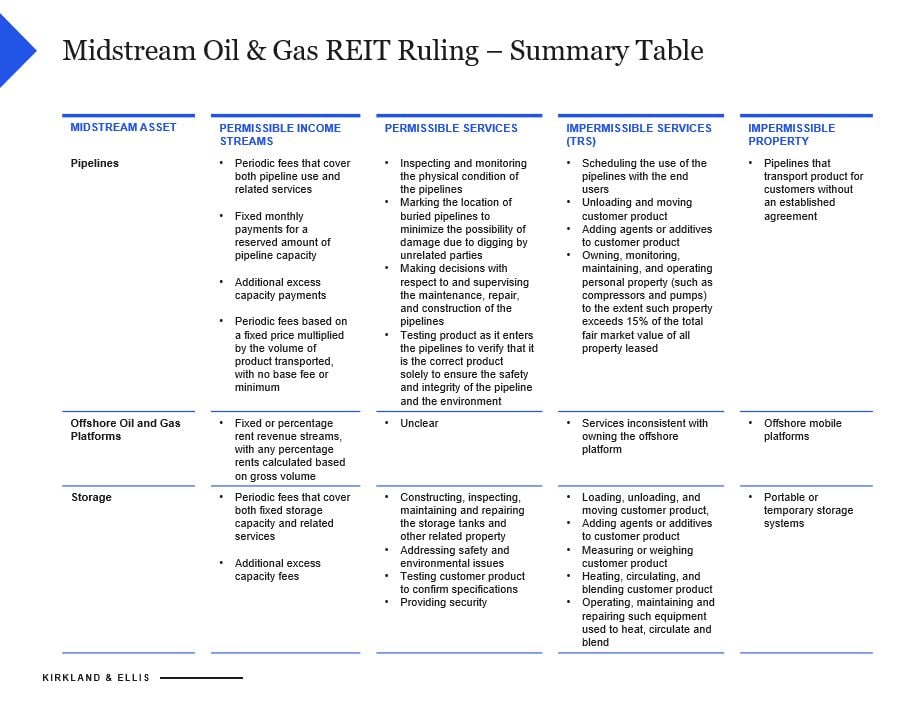

The chart below outlines some of the income streams and services permitted under the ruling. While non-precedential for other midstream investors, the ruling may be viewed as indicative of the IRS’s current views of the scope of the REIT rules in the midstream space, and may open the doors to a welcome new source of capital in the midstream space.

Next Steps

Companies in the midstream oil and gas space should look carefully at their investments and investor base to determine whether the use of REITs is feasible and beneficial under these new rules. Under appropriate facts, the use of a REIT to hold midstream energy investments could add significant value over historical structures.

Read more insights from Kirkland's Energy & Infrastructure blog.

This publication is distributed with the understanding that the author, publisher and distributor of this publication and/or any linked publication are not rendering legal, accounting, or other professional advice or opinions on specific facts or matters and, accordingly, assume no liability whatsoever in connection with its use. Pursuant to applicable rules of professional conduct, portions of this publication may constitute Attorney Advertising.

This publication may cite to published materials from third parties that have already been placed on the public record. The citation to such previously published material, including by use of “hyperlinks,” is not, in any way, an endorsement or adoption of these third-party statements by Kirkland & Ellis LLP.