Maybe Not the Center of the Universe, but Close; Chicago is Becoming a Hub of Activity as Recovery Spurs Dealmaking and Firm Growth

The cloud of doom and gloom has dissipated over Chicago's legal market. With the economy picking up and law firms needing fresh bodies to replace the thousands laid off last year, 2010 has witnessed an increase in associate hiring. Lateral partners are being plucked from bigger firms.

Frankly, the law firms with their bare-boned staffs didn't have much choice, according to legal recruiter Gary D'Alessio, president of Chicago Legal Search. "I've been recruiting now for nearly 25 years and I can assure you, it was the worst," said D'Alessio, who witnessed thousands of layoffs during 2009. "So many firms cut to the bone…and when you have gutted an entire class, your hand is forced."

Forced to rehire, that is. "There's definitely been an uptick in the market," he said. "And thank God."

On the lateral front, big moves in Chicago in 2010 included DLA Piper's hiring of Marc Horwitz, who was the head of Baker & McKenzie's North American derivatives practice, and Jenner & Block's hiring back of corporate partner David Savner from General Dynamics Corp., where he had been general counsel.

Chicago's largest lateral move last year may have been the merger of Chicago-based Bell, Boyd & Lloyd into K&L Gates, which brought the latter 122 new partners. K&L Gates tops The National Law Journal affiliate The American Lawyer's list of firms that made the most lateral partner hires during 2009.

In addition to Horwitz, DLA brought on Ralph Dudziak, a former Mayer Brown partner who specializes in complex equipment leasing and lending transactions, and Gregory Hayes, a former associate general counsel at Chicago-based mall owner General Growth Properties Inc.

On the flip side, DLA lost two top labor and employment partners: Adrianne Mazura, who had chaired DLA's Chicago practice; and Tracy Bradford Farley, who split in January for the Chicago office of Quarles & Brady.

Then there were the newer entrants such as Baker Hostetler, which opened its Chicago office in October 2009 with just one lawyer and now is up to 16.THE PLACE TO BE

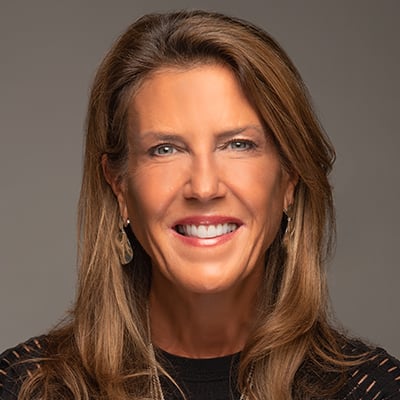

Make no mistake, Chicago is the place to be for attorneys looking to score big and lucrative deals, said Linda Myers, a partner at Chicago's Kirkland & Ellis. "You're talking to a former New York lawyer. I used to think that the center of the universe was New York and that all the hot deals you read about must be coming from New York," she said. "That couldn't be further from the truth. The big transactional practice — you can have it in Chicago, too."

Regarding associate hiring, incoming classes are definitely bigger, Myers said. Better yet, they actually will start this year — not like in 2008 and 2009, when start dates were delayed, up to one year at some firms. This year, Myers said, there's a heavier workload. And fresh blood is high in demand. "This year, we'll start people earlier because we're really busy," she said. "It's a much more joyful time." Kirkland's class of 49 Chicago associates, down from 61 last year, is scheduled to start in September.

As for workloads, Kirkland's corporate practice has picked up enormously, and restructuring, intellectual property and litigation practices continue to be busy. Even the real estate people are "incredibly busy" handling all the distressed inventory, Myers said. Basically, she explained, with the markets stabilizing and capital available again, more people are able to do deals, which translates into more work for the lawyers. "We're going gangbusters," she said. "We need people. We're hiring."

Ray Werner, partner and chairman of the executive committee at Chicago's Arnstein & Lehr, is experiencing a similar bliss. "We were able to come through 2008 and 2009 stronger than we came into it," he said.

Bankruptcy and litigation are hot areas for his firm of 150 lawyers. Chicago's midsize firms have fared well through the recession as companies have turned to them to litigate the cases that don't involve "company-busting litigation," he said. Midsize firms are handling more commercial, trade secrets and employment contract cases.

"People are looking to us as good lawyers and value providers," he said. "I think we're holding our competitive place."

Meanwhile, larger firms appear to be moving in on the midsize firms' turf. As Werner noted and others confirmed, there's been a growing movement by large, out-of-state firms to set up offices in Chicago. He is sometimes baffled by their presence. "If they have clients with in-state business, I understand. But just to have a Chicago office?" he said.

It's not just about the office — it's a business necessity, said Jennifer Kenedy, managing partner of the 123-attorney Chicago office of Locke Lord Bissell & Liddell. "We don't really believe in growth for growth's sake, but we are looking to grow our corporate office for our clients, a lot of whom have legal needs in Chicago," she said. "It's one of our larger offices."

D'Alessio, who tracks law firm developments in Chicago, said that at least 87 out-of-state law firms maintain offices in Chicago, 20 of which opened during the past two years — at the peak of the recession. That tells you something about Chicago's legal market, he said. "Despite the market going south, almost 20 offices is crazy," said D'Alessio, who expects that at least 10 more firms will open offices in Chicago during the next couple of years.

The way he sees it, if a law firm wants to be competitive on a national scale, "you're going to definitely come to Chicago."

REPRINTED WITH PERMISSION FROM THE AUGUST 9, 2010 EDITION OF THE NATIONAL LAW JOURNAL © 2010 ALM. ALL RIGHTS RESERVED. FURTHER DUPLICATION WITHOUT PERMISSION IS PROHIBITED