UK Tax Insolvency Reforms

At a Glance

The UK government has published draft legislation to implement two changes particularly relevant for the restructuring and insolvency market.

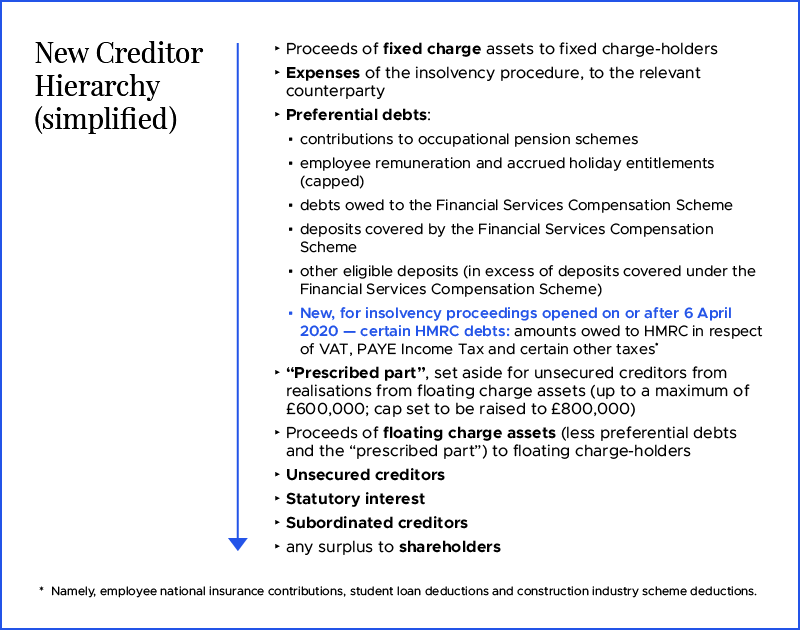

- HMRC as preferential creditor: From April 2020, HMRC will become a preferential creditor for certain debts relating to taxes paid by employees and customers. HMRC’s priority status is expected to reduce returns for floating charge and unsecured creditors, which may reduce appetite for lending and increase funding costs for UK companies, and lead to greater recourse to fixed charge and asset-based lending.

- Tax abuse and insolvency: Directors may be held personally liable for a company’s tax liabilities where HMRC considers that avoidance or evasion has taken place, or where they have evidence of “phoenixism”.1 The measure aims to ensure that genuine insolvencies are not caught, with the added safeguard of an appeal right.

The government expects these measures to raise c.£195m/year at their peak.

HMRC as preferential creditor

This reform will raise HMRC from an unsecured creditor to a secondary preferential creditor in insolvencies commencing on or after 6 April 2020, but only in respect of VAT, PAYE Income Tax and certain other taxes.2 HMRC will, however, remain an unsecured creditor for taxes levied directly on businesses, such as corporation tax and employer national insurance contributions.

The policy, announced without consultation in the Autumn Budget 2018, aims to increase returns for HMRC in insolvencies. Until 2003, HMRC ranked as preferential creditor and the reintroduction of a Crown preference is seen by many as a retrograde step.

Key Details

The latest publications clarify that:

- historic tax debts will be included, without time limit or cap;

- penalties and interest will not form part of HMRC’s preferential claim;

-

HMRC’s preferential status will apply over all floating charges, whether created before or after April 2020; and

-

the measure will have no effect on insolvency proceedings commencing before 6 April 2020.

Implications

The government has indicated that it does not expect the proposed reform to have a material impact on lending. However, the proposed reform looks set to reduce appetite for lending and increase funding costs, especially for SMEs. It appears likely that tax will begin to distort lending arrangements again, with fixed-charge and asset-based lending set to increase to achieve priority over HMRC, instead of creditors relying on floating charges.

There is also concern that the proposed reform will give HMRC too much influence in insolvency processes. For example, the use of a company voluntary arrangement to compromise HMRC will become substantially more difficult, given constraints on compromising preferential debts within a CVA unless the preferential creditor consents.3 The government has attempted to address these concerns, but it is clear HMRC’s interests may not be aligned with those of other creditors and it may now hold a de facto veto in certain scenarios.

HMRC will still share in the prescribed part (set aside from floating charge realisations for unsecured creditors) in respect of their non-preferential claims (e.g., for corporation tax) — effectively giving HMRC a second bite at the cherry.

Tax abuse using company insolvencies

To tackle perceived abuse of insolvency processes to reduce companies’ tax bills, the Finance Bill introduces a new regime giving HMRC power to make directors and other connected persons jointly and severally liable for the avoidance, evasion or “phoenixism” debts of a corporate entity.

The proposed measure will apply to all tax periods ending after the date on which the Finance Bill 2019 is passed. (Timing is uncertain given the UK political situation, but 1Q20 currently appears most likely.)

HMRC may issue a “joint liability notice” to an individual in:

- tax avoidance and tax evasion cases;

- repeated insolvency and non-payment cases; and

- cases where a penalty is imposed for facilitating avoidance or evasion.

See the Appendix for further details. Safeguards include a right of appeal.

The government is clear that the majority of insolvencies arise as a consequence of genuine financial difficulties, and that this reform is targeted at the minority that seek to misuse insolvency to avoid meeting their tax liabilities. Nonetheless, these measures will increase the pressure on those running distressed companies, and tax diligence expectations, at what is already a difficult time for all involved.

Implementation

The final legislation will be subject to confirmation in the Autumn Budget (the date for which has yet to be scheduled). Timing for the passing of the legislation is uncertain given the UK political situation, as noted above; 1Q20 currently appears most likely.

See further:

- On HMRC as preferential creditor: summary of responses to “Protecting your taxes in insolvency”, 11 July 2019; policy paper and related materials, including draft legislation, which forms part of the Finance Bill 2019-2020 and will amend the Insolvency Act 1986.

- On tax abuse using company insolvencies: policy paper and related materials, including draft legislation, which forms part of the Finance Bill 2019-2020.

Appendix

Conditions for the issue of a joint liability notice

Tax avoidance and tax evasion cases

HMRC may issue a joint liability notice to an individual where the following conditions are met:

- the company has engaged in tax avoidance or evasion;

- the company is subject to an insolvency procedure,4 or there is a serious risk that it will be;

- the person:

- was responsible for the company’s conduct, or benefited from it, when the individual was a director or shadow director of the company, or a participator in the company; or

- enabled or facilitated the company’s conduct, when the individual was a director or shadow director of the company, or took part in management of the company;

- there is likely to be a tax liability arising from the avoidance or evasion; and

- there is a serious possibility that some or all of that liability will not be paid.

Repeated insolvency and non-payment cases

HMRC may issue a joint liability notice to an individual where the following conditions are met:

- in the five years prior to the notice, the person had a relevant connection to at least two companies which became subject to an insolvency procedure4 and owed amounts to HMRC (where the individual was a director or shadow director of the company, or a participator in the company);

- the new company carries on a business which is the same as, or similar to, that of the insolvent companies;

- the person is connected to the new company (i.e., is a director or shadow director of the company, or a participator in the company, or took part in management of the company); and

- the old companies became insolvent with an unpaid tax liability of more than £10,000 and more than 50% of the total amount of those companies’ liabilities to their creditors.

The notice cannot be issued more than two years after HMRC first became aware of the facts.

Helpfully, the explanatory notes to the draft legislation indicate that this power will not be used in respect of “turnaround specialists” whose connection with the companies is part of a genuine attempt to save the company. However, this continues the current (unfortunate) trend in drafting tax legislation widely such that it captures both “in scope” and “out of scope” behaviours and then relying on guidance or similar to provide “reassurance” that out of scope cases will not be pursued.

Cases where a penalty is imposed for facilitating avoidance or evasion

HMRC may issue a joint liability notice to an individual where the following conditions are met:

- HMRC has imposed a penalty under certain specified tax provisions, such as penalties for promoters of tax avoidance schemes or enablers of offshore tax evasion;

- the company is subject to an insolvency procedure,4 or there is a serious risk that it will be;

- the person was a director or shadow director of the company, or a participator in the company; and

- there is a serious possibility some or all of that penalty will not be paid.

1. “Phoenixism” is the practice of running up liabilities in a limited liability entity, then avoiding paying them by making the company insolvent — and setting up a new company carrying on broadly the same business (often to repeat the practice).↩

2. Namely, employee national insurance contributions, student loan deductions and construction industry scheme deductions.↩

3. Section 4(4) Insolvency Act 1986.↩

4. A scheme of arrangement will be included as an insolvency procedure for this purpose, as will foreign insolvency procedures or schemes if they correspond to their UK counterparts.↩

© 2019 KIRKLAND & ELLIS INTERNATIONAL LLP. All rights reserved