FCA Market Watch 60: Inside Information Systems & Controls

The UK Financial Conduct Authority ("FCA") has published Market Watch 60, its newsletter on market conduct and transaction reporting issues. This edition contains information about the FCA’s view on controlling access to inside information, findings of the FCA’s Thematic Review of processes controlling information flows, and its key recommendations.

MAR and Inside Information

‘Inside information’ under the EU Market Abuse Regulation 2016 ("MAR") is information of a precise nature that has not been made public relating directly or indirectly to one or more issuers or financial instruments that, if it were made public, would be likely to have a significant effect on the prices of those financial instruments or on the price of related derivative financial instruments.

MAR makes insider dealing, unlawful disclosure, market manipulation and attempted manipulation civil offences and gives the FCA powers and responsibilities for preventing and detecting market abuse. For breaches of MAR, the FCA can impose unlimited fines, order injunctions, or prohibit regulated firms or approved persons from conducting regulated activities.

Insider Dealing: A Criminal Offence

Insider dealing is a criminal offence under Part V of the Criminal Justice Act 1993. Under section 52, an offence is committed if an insider deals in (or encourages others to deal in) price-affected securities when in possession of inside information (or makes improper disclosure of such information). The definition of inside information in the Criminal Justice Act is broadly aligned with the definition of inside information under MAR.

Criminal sanctions for insider dealing and market manipulation can incur custodial sentences of up to seven years and unlimited fines.

FCA Findings

The FCA’s review in Market Watch 60 follows the conviction of a former compliance officer in the London branch of a major investment bank, who was found guilty of five counts of insider dealing, as well as of unlawful disclosure of inside information.

The FCA commented that it recently highlighted the importance of firms being able to identify conduct risks to ensure that they have effective market abuse controls in place, both inside and outside of the firm. It notes that when investigating suspected insider dealing, it is important to establish who had access to inside information at particular points in time. The FCA stresses the need for firms in possession of inside information to maintain ‘insider lists’ pursuant to the legal requirements under MAR.

Market Watch 60 references the FCA’s recent review of investment banks, legal advisers and other consultancies to manage access to inside information. The FCA’s findings include:

- large number of support staff having access to inside information;

- failures to restrict access to inside information to those who need it for the proper fulfilment of their role;

- absence of regular reviews of access rights;

- insider lists containing generic descriptions of functions of the non-deal team, making it difficult to track and control how inside information was being communicated internally;

- electronic files containing deal-specific information stored in general team folders; and

- incomplete audit trails.

FCA Key Recommendations

The FCA concludes that it views a firm’s inability to respond to a regulatory request with accurate records of who had access to inside information as an indication of underlying weaknesses in systems, procedures and policies of that firm. It adds that by allowing widespread and unchallenged access to inside information to individuals who do not require it to perform the proper functions of their employment, firms increase the risk of that information being disclosed unlawfully. Firms that cannot respond appropriately to FCA requests may be subject to further regulatory scrutiny.

Firms need to undertake an assessment of the nature of their businesses, the market abuse risks that may arise as a consequence, and the systems and controls that are most suited to mitigate those risks. In particular, the FCA expects firms to take reasonable steps to ensure that the risks of handling inside information are identified and appropriately mitigated.

FCA’s Increased Enforcement Focus on MAR

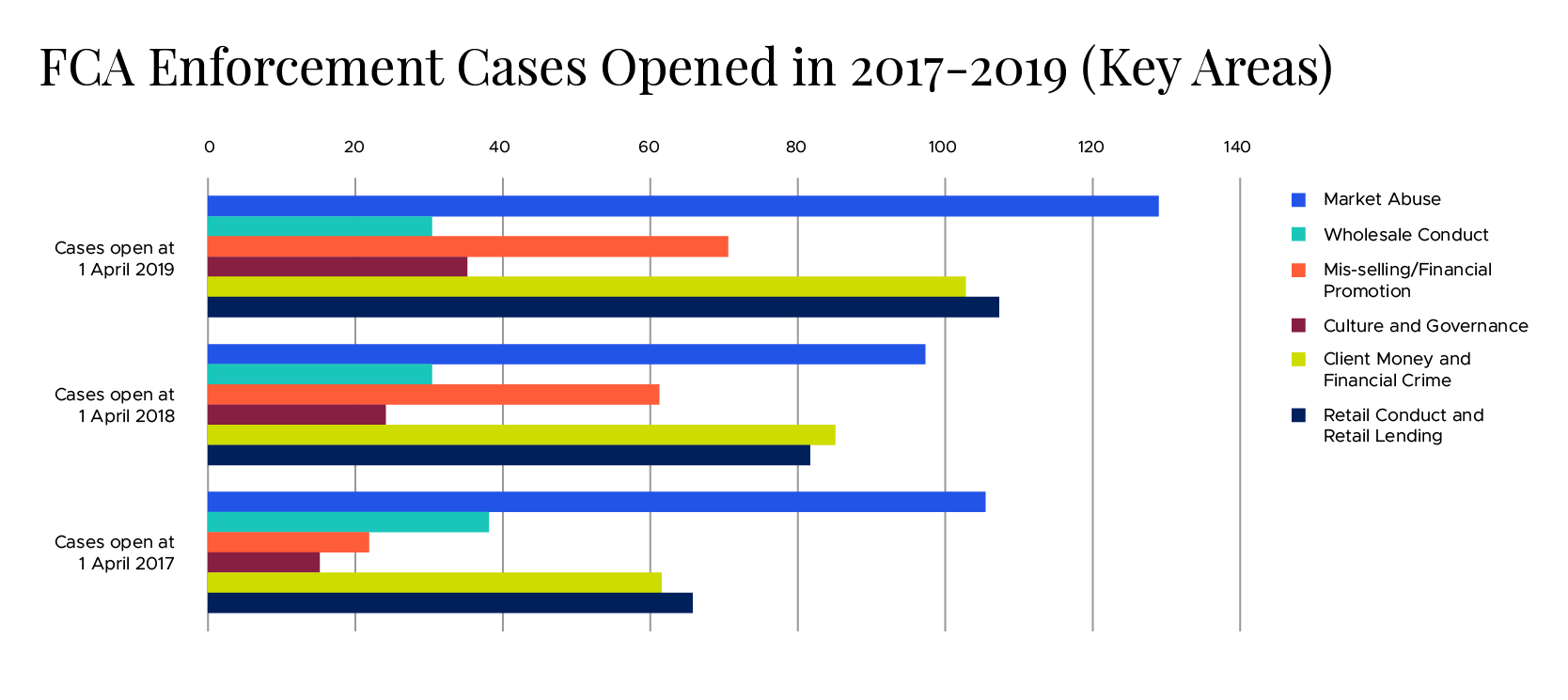

The graph below shows a breakdown of the FCA's open enforcement investigations, compared to the same breakdown published by the FCA for the previous two years. The statistics are clear — market abuse systems, controls and surveillance are central to its regulatory activities in the wholesale financial markets.

FCA’s Market Abuse Action in the Last 12 Months

Consistent with its enforcement trends, the FCA’s 2019/20 Business Plan underscores its continued attention to working with issuers to increase their knowledge of MAR and ensure that their systems and controls match the market abuse risks that they and their investors face. The FCA also notes that it is producing guidance on the assessment, handling and disclosure of inside information for other industry regulators and public bodies, which will support them in understanding their obligations under MAR.

In keeping with scrutiny on both firms and individuals, the FCA published on 30 April 2019 the final notice it issued to a prime broker and hedge fund incubator fining it £409,300 related to market protection and market abuse in the trading firm sector.

The FCA’s commentary in Market Watch 58 on market conduct and transaction reporting issues describes the results of the review of the industry’s implementation of MAR in December 2018.

© 2019 KIRKLAND & ELLIS INTERNATIONAL LLP. All rights reserved