ISSB’s Proposed Framework Seeks to Unify Global Sustainability Disclosure Standards

On March 31, 2022, the International Sustainability Standards Board (ISSB), an investor-focused initiative of the International Financial Reporting Standards (IFRS) Foundation, released long-anticipated drafts of its sustainability reporting standards: the General Requirements for Disclosure of Sustainability-Related Financial Information (the “General Requirements Standard”) and a Climate-Related Disclosures framework (the “Climate Standard”). The publication of these two draft standards represents a potentially significant step toward the coalescence of voluntary corporate sustainability reporting frameworks and could influence mandatory disclosure regimes that are evolving in the U.S., UK and EU.

In this Alert, we outline the contents of the draft standards — focusing on the General Requirements Standard — and situate them within the context of converging voluntary disclosure standards and increasing regulation. We then share key takeaways for companies that are beginning or continuing to make sustainability-related disclosures.

Overview of ISSB Framework

At a high level, the ISSB aims to help companies streamline their sustainability disclosures to facilitate an “apples to apples” comparison by investors. Currently, companies and financial institutions utilize a variety of voluntary frameworks — often referred to as the ESG “alphabet soup” — to guide disclosure in sustainability reports and other corporate communications. The ISSB intends to detail baseline requirements that ensure companies provide investors with a complete set of disclosures on sustainability risks and opportunities that could affect enterprise value, in order to complement the information provided in financial statements.

The General Requirements Standard creates an umbrella of disclosure expectations that will apply across all of the ISSB’s forthcoming sustainability topic-specific standards, including the Climate Standard. ISSB has indicated it will consult with stakeholders on other sustainability topics later in 2022, potentially including water, biodiversity and social issues.

Like the U.S. Securities and Exchange Commission’s (SEC) recently proposed climate-related risk disclosure rule1, the ISSB’s General Requirements and Climate Standards are based on the recommendations of the Task Force on Climate-Related Financial Disclosures (TCFD). The recommendations of both the ISSB and the TCFD fall into four broad pillars — governance, strategy, risk management, and metrics and targets — corresponding to how the disclosing company approaches these four practices in the context of a given sustainability topic. Although the TCFD’s recommendations are specific to climate-related risks and opportunities, the ISSB’s General Requirements Standard advises that this approach be applied to all sustainability issues that could impact enterprise value, such as those posed by social or nature-related issues.

Notably, the ISSB’s disclosure regime is predicated on an assessment of financial materiality. The General Requirements Standard recommends that companies disclose “material” sustainability-related information, defined as information that “could reasonably be expected to influence primary users’ assessments of an entity’s enterprise value,” with the responsibility for the materiality assessment resting on the reporting entity. The General Requirements Standard specifies that potentially material sustainability-related considerations include activities and relationships related to an entity’s “value chain,” which it defines as “the full range of activities, resources and relationships related to a reporting entity’s business model and the external environment in which it operates.”

To make an assessment of materiality, the ISSB recommends that companies consult the industry-specific materiality factors outlined by the Sustainability Accounting Standards Board (SASB) Standards, as well as the most up-to-date topic-specific guidance of other standard-setting bodies, such as the Climate Disclosure Standards Board’s (CDSB) guidance for water- and biodiversity-related disclosures.

Convergence of Voluntary Sustainability Reporting Frameworks and Increasing Regulation

At a conceptual level, the General Requirements Standard attempts to unite multiple overlapping approaches to sustainability disclosure. To accomplish this, the General Requirements Standard recommends that companies provide both quantitative data-based disclosures as well as qualitative narrative-driven disclosures. Furthermore, the ISSB recommends that entities rely on industry-specific guidance for certain disclosures in addition to industry-agnostic general reporting guidance.

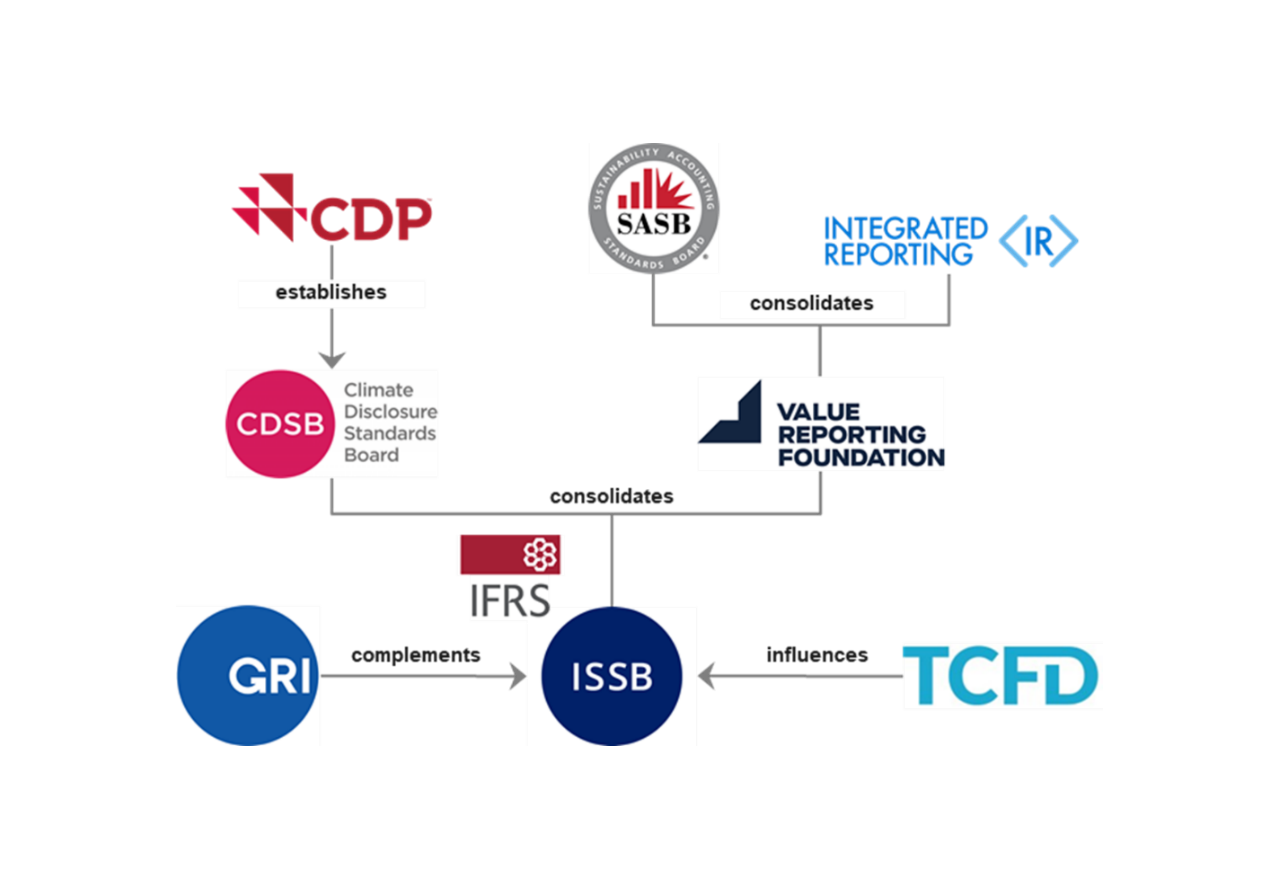

Alongside this conceptual harmonization, the ISSB’s framework advances a general organizational convergence among some of the most widely used global standard-setting bodies. In 2021, SASB and the Integrated Reporting Framework combined to form the Value Reporting Foundation, which, alongside the CDSB, will fold into the ISSB by June 2022. Furthermore, the Global Reporting Initiative (GRI) — which provides standards for companies to disclose their environmental and social impacts to a broader set of stakeholders than investors and is the most widely used disclosure system globally — has pledged to coordinate its future standard-setting activities with those of the ISSB to provide two “pillars” of international sustainability reporting. This convergence is illustrated in Figure 1 below.

Figure 1: Convergence of Voluntary Sustainability Disclosure Standards

In addition to potentially helping to drive convergence of voluntary sustainability disclosure standards, the ISSB could also play a role in the evolving regulatory shift from voluntary to mandatory sustainability reporting, again potentially helping to drive global compatibility among corporate disclosures. The IFRS’s accounting rules issued and maintained by the International Accounting Standards Board (IASB), on which the ISSB is modeled, have been adopted in over 100 countries, and the IFRS intends to co-develop the two independent sets of standards to ensure their connectivity, compatibility and relevancy to investors.

Finally, a number of prominent global financial regulators — including the SEC, the UK Financial Conduct Authority, the European Commission, the European Financial Reporting Advisory Group (EFRAG), the Japanese Financial Services Authority, the Sustainability Standards Board of Japan Preparation Committee and the Chinese Ministry of Finance — have agreed to join a working group focused on compatibility between the ISSB’s standards and new regulations. The UK government has gone a step further, signaling it intends to adopt the ISSB’s standards as part of future mandatory sustainability reporting requirements under the Sustainability Disclosure Regulation (SDR).2

Key Takeaways

Given the ISSB’s potential to influence voluntary and mandatory sustainability reporting expectations, companies may wish to consider using its standards to help inform their sustainability disclosure strategy. Below, we highlight three key takeaways from the draft General Requirements and Climate Standards.

Centrality of TCFD and SASB: As described above, the ISSB’s General Requirements Standard centers on the four pillars of the TCFD framework, which are geared toward integrating sustainability risk assessment into the core processes of a company’s business, as well as the industry-specific disclosures outlined by the SASB Standards. Influential investors such as BlackRock have previously encouraged companies to voluntarily disclose in line with both TCFD and SASB, and companies that have already developed such procedures for sustainability reporting will find it easier to adapt to the ISSB’s framework.

Integration with Financial Reporting: Like the SEC’s proposed climate rule, the General Requirements Standard recommends that sustainability-related information be disclosed alongside an entity’s general purpose financial reports as part of the ISSB’s emphasis on the materiality of sustainability-related disclosures to investors. Although the ISSB does not provide specific guidance on where such disclosures must be made relative to general purpose financial reports, it emphasizes that sustainability-related information should be disclosed simultaneously with standard financial information and in as integrated a manner as possible.

Divergence of Materiality Approaches: As discussed, the concept of financial materiality is central to the General Requirements Standard. However, the concept of “double materiality,” which includes environmental and social impacts of a company’s operations even if not financially material to the company, has significant support outside of the ISSB’s framework. As noted above, the GRI’s disclosure standards adopt a broad, multi-stakeholder interpretation of materiality. Additionally, EFRAG’s draft European Sustainability Reporting Standards for the Corporate Sustainability Reporting Directive incorporate disclosure obligations that include entities’ impacts on nature, society and the climate. Companies therefore may wish to consider the ISSB’s standards a baseline for reporting, as opposed to an exhaustive set of disclosures.

Conclusion

The ISSB will accept feedback on its General Requirements and Climate Standards until July 29, 2022, and will incorporate the comments it receives into its final sustainability reporting standards, expected by the end of 2022.

Companies are advised to monitor the continued development of the exposure drafts and may wish to consider aligning future sustainability reporting with key components of the General Requirements Standard, including relying on company- and industry-appropriate standards such as those of SASB. As the process of sustainability reporting moves from voluntary to mandatory, companies with mature sustainability disclosure programs are likely to be well positioned to meet the evolving demands of stakeholders and regulators.

1. For an overview of the SEC’s proposed climate rule and its implications, please refer to our March 24 Alert.↩

2. A consultation paper on the SDR is expected in the second quarter of 2022.↩