SEC Adopts Pay Versus Performance Disclosure Rules

On August 25, 2022, the SEC adopted final rules implementing the pay versus performance disclosure required by Section 953(a) of the Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Pay vs. Performance Disclosure Rules”). The Pay vs. Performance Disclosure Rules add a new Item 402(v) to Regulation S-K and will go into effect for the 2023 proxy season.

Although many registrants have historically included a description of their pay-for-performance elements of compensation in their CD&As, the new Pay vs. Performance Rules go much further by requiring registrants to disclose how the compensation actually paid to their named executive officers over the previous five fiscal years relates to the financial performance of the registrant and its peers over that period. The implementation of the new Pay vs. Performance Disclosure Rules will require significant planning and preparation for all affected registrants.

Below is a brief summary of the final rules (the final release is linked here). We are working on a more detailed toolkit to assist clients with the implementation of the Pay vs. Performance Disclosure Rules for the 2023 proxy season.

Affected Registrants

The Pay vs. Performance Disclosure Rules will apply to all reporting companies other than (i) foreign private issuers, (ii) registered investment companies and (iii) emerging growth companies. Smaller reporting companies (“SRCs”) will be subject to scaled back disclosure requirements under the Pay vs. Performance Disclosure Rules.

Timing

The Pay vs. Performance Disclosure Rules will become effective 30 days following publication of the release in the Federal Register, and will apply to any proxy and information statement where shareholders are voting on directors or executive compensation that is filed in respect of a fiscal year ending on or after December 16, 2022. Accordingly, the vast majority of registrants who are subject to the Pay vs. Performance Disclosure Rules will be required to include related disclosure for their 2023 proxy statements.

Required Disclosure

The Pay vs. Performance Disclosure Rules require the following three new elements of disclosure: (i) prescribed tabular disclosure, (ii) additional comparative disclosure that can be presented in either graphical or narrative form (or a combination thereof) and (iii) a tabular list of financial performance measures selected by the registrant.

(i) Tabular Disclosure

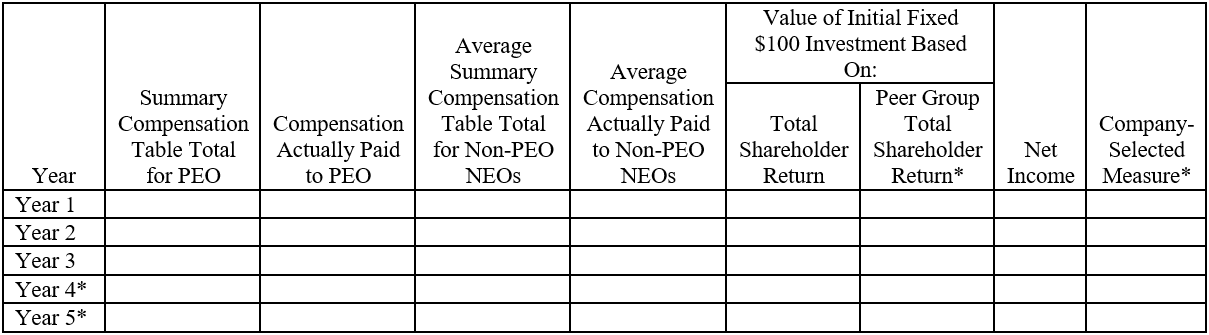

The following disclosure must be included in the table set forth below:

*Asterisked items indicate portions of the final rules from which SRCs are exempt.

- Covered Years.

- Non-SRC Registrants: For registrants that are not SRCs, this tabular disclosure must be provided for the registrant’s five most recently completed fiscal years. However, in the first proxy statement that includes this disclosure, only three fiscal years will be required, with an additional fiscal year added in each of the registrant’s two subsequent annual proxy filings.

- SRC Registrants: For registrants that are SRCs, this tabular disclosure must be provided for the registrant’s three most recently completed fiscal years. However, in the first proxy statement that includes this disclosure, only two fiscal years will be required, with an additional fiscal year added in the registrant’s subsequent annual proxy filing.

- Compensation.

- Total Compensation Paid: The total compensation paid to (i) the registrant’s principal executive officer (“PEO”) and (ii) as an average, the registrant’s other named executive officers (“NEOs”).

- This will be the amount reported in the Summary Compensation Table for the applicable fiscal year.

- Registrants must identify in footnote disclosure the individual NEOs whose compensation amounts are included in the average for each fiscal year.

- For any fiscal year where a registrant had multiple PEOs, the table must include separate compensation columns for each applicable PEO.

- Compensation Actually Paid: The compensation actually paid to (i) the PEO and (ii) as an average, the other NEOs.

- This amount will reflect the total compensation reported in the Summary Compensation Table, but with the pension values and equity awards adjusted as follows:

- Pension Values: Adjusted by, (i) subtracting from the Summary Compensation Table total the aggregate change in the actuarial present value of all defined benefit and actuarial pension plans, and (ii) adding back the aggregate of the following two components:

- The actuarially determined service cost for services rendered by the executive during the applicable fiscal year; plus

- The entire cost of benefits granted in a plan amendment (or initiation) during the covered fiscal year that are attributed by the benefit formula to services rendered in periods prior to the plan amendment or initiation.

- Equity Awards: Adjusted by (i) subtracting the grant date fair value of the equity award amounts reported in the Summary Compensation Table for each applicable fiscal year, and (ii) adding or subtracting, as applicable, for each applicable fiscal year as follows:

- Adding the year-end fair value of any equity awards granted in the covered fiscal year that are outstanding and unvested as of the end of the covered fiscal year;

- Adding the fair value of the vesting date for awards that are granted and vest in the same covered fiscal year;

- Adding the dollar value of any dividends or other earnings paid on stock or option awards in the covered fiscal year prior to the vesting date that are not otherwise reflected in the fair value of such award or included in any component of total compensation for the covered fiscal year;

- Adding or subtracting the amount of change as of the end of the covered fiscal year (from the end of the prior fiscal year) in fair value of any awards granted in prior years that remain outstanding and unvested as of the end of the covered fiscal year;

- Adding or subtracting the amount equal to the change as of the vesting date (from the end of the prior fiscal year) in fair value for awards granted in prior years that vested in the covered fiscal year; and

- Subtracting the amount equal to the fair value at the end of the prior fiscal year for awards granted in prior years that are forfeited during the covered fiscal year.

- Appropriate footnote disclosure will be required to identify the amount of each adjustment and any valuation assumptions that materially differ from those disclosed at the time of grant.

- Pension Values: Adjusted by, (i) subtracting from the Summary Compensation Table total the aggregate change in the actuarial present value of all defined benefit and actuarial pension plans, and (ii) adding back the aggregate of the following two components:

- This amount will reflect the total compensation reported in the Summary Compensation Table, but with the pension values and equity awards adjusted as follows:

- Total Compensation Paid: The total compensation paid to (i) the registrant’s principal executive officer (“PEO”) and (ii) as an average, the registrant’s other named executive officers (“NEOs”).

- Financial Performance Measures.

- TSR: The registrant’s total shareholder return (“TSR”).

- TSR (and peer group TSR) must be calculated based on a fixed investment of $100 at the measurement point, on the same cumulative basis as is used in Item 201(e) of Regulation S-K.

- Example: For fiscal year 2020, after looking at the closing stock price on December 31, 2019 and on December 31, 2020, it is determined that the stock price increased by 25% over such period. The registrant would then multiply $100 by 125% and report $125 in the table for fiscal year 2020.

- Peer Group TSR: The TSR for the registrant’s peer group.

- The peer group used for this tabular disclosure must be either (i) the peer group used by the registrant for purposes of Item 201(e) of Regulation S-K (the “Industry Peer Group”) or (ii) the peer group used in the registrant’s CD&A for purposes of disclosing compensation benchmarking practices (the “Compensation Peer Group”).

- If the registrant changes the peer group used in this tabular disclosure from a peer group that was used in a previous fiscal year, appropriate footnote disclosure must be included.

- Net Income: The registrant’s net income.

- Company-Selected Measure: The registrant’s “Company-Selected Measure.”

- This is a financial performance measure selected by the registrant that represents the registrant’s most important financial performance measure (that is not otherwise required to be disclosed in the table) used by the registrant to link compensation actually paid to its NEOs to company performance for the most recently completed fiscal year.

- This performance measure must be selected from the registrant’s Tabular List, as further described below.

- Registrants are not required to disclose the methodology used to calculate the Company-Selected Measure.

- TSR: The registrant’s total shareholder return (“TSR”).

- Inline XBRL. Registrants will be required to use Inline XBRL to tag this tabular disclosure.

(ii) Comparative Disclosure (Graphical, Narrative or a Combination)

- Payment and Performance Relationship. Registrants will be required to disclose a clear description of the relationship between each of the financial performance measures included in the tabular disclosure and the compensation actually paid to the NEOs during the five most recent fiscal years. The SEC has provided the following examples:

- This disclosure could include a graph providing executive compensation actually paid and change in the financial performance measures on parallel axes and plotting compensation and such measures over the required time period.

- Alternatively, this disclosure could include narrative or tabular disclosure showing the percentage change over each fiscal year of the required time period in both executive compensation actually paid and the financial measures together with a brief discussion of how those changes are related.

-

TSR and Peer Group Relationship. Registrants will also be required to disclose a clear description of the relationship between the registrant’s TSR and the registrant’s peer group TSR during the five most recently completed fiscal years.

(iii) Tabular List

- General Requirements. Registrants will be required to provide an unranked list of three to seven financial performance measures (which will include the Company-Selected Measure) that are the “most important” measures used by the registrant to link the actual compensation paid to the NEOs to company performance for the most recent fiscal year (the “Tabular List”).

- Presentation. The Tabular List may be presented in three different ways: (i) one list, (ii) two separate lists, with one for the PEO and one for the remaining NEOs, or (iii) separate lists for the PEO and each of the NEOs. If using more than one list, each list must include between three to seven financial performance measures (subject to the exceptions described below).

- Non-Financial Measures. Registrants are permitted, but not required, to include non-financial performance measures (e.g., ESG metrics) in the Tabular List if such measures are among their three to seven most important performance measures.

- Less than Three Performance Measures. If a registrant uses less than three performance measures to link executive compensation actually paid to company performance, then the registrant will only be required to disclose the measures that it actually considers. Further, if the registrant does not use any performance measures, then it will not be required to disclose a Tabular List.

What Should Registrants Start Doing Now?

Given the expansive nature of these new disclosure requirements, registrants should not wait until the end of the 2022 calendar year to begin planning and preparing for the new disclosure requirements. Below are some steps that registrants can take now to be well-positioned going into the 2023 proxy season.

Reach out to the Compensation Consultant and Legal Advisors. Registrants should begin discussing their approach with their compensation consultant and corporate governance counsel, specifically: (i) which Company-Selected Measure would be most appropriate to use in the tabular disclosure; (ii) whether graphic and/or narrative disclosure will be preferable for the comparative disclosure; (iii) which performance measures are “most important” and should be included in the Tabular List; and (iv) the most appropriate location in the proxy statement for the new disclosure.

Talk to the Compensation Committee Chairperson. Management should reach out to the chair of the compensation committee to alert them of the new Pay vs. Performance Disclosure Rules, and to include that director in the discussions with the compensation consultant and corporate governance counsel.

Gather the Historical Data. Registrants should coordinate with their HR and accounting departments to begin to calculate the “compensation actually paid” values for fiscal years 2020 and 2021.

Reach out to Pension Plan Administrator/Actuary. Registrants with a pension plan should reach out to their pension actuary/plan administrator regarding the necessary data needed to calculate the relevant “compensation actually paid” values.

Determine the Peer Group. Registrants should determine whether the Industry Peer Group or the Compensation Peer Group would be most appropriate for purposes of the TSR peer group comparison.

Mock-up the Pay Versus Performance Table. Once historical data has been gathered, registrants should create an initial mock-up of the new table to better understand how the information presents.

Consider Whether Additional Voluntary Disclosure is Desirable. Once historical data has been gathered and a mock-up table created, management and the compensation committee should discuss with the compensation consultant whether supplemental voluntary disclosures would be appropriate to include for a complete picture, given that in most cases there will be a disconnect between how the compensation committee actually determines compensation and how corporate performance and “compensation actually paid” values are presented under the new Pay vs. Performance Disclosure Rules.

Conclusion

The new Pay vs. Performance Disclosure Rules will create a substantial new work stream for both management teams and outside advisors of affected registrants. However, with advanced thinking and planning, registrants will be able to meet those requirements and ensure that the new disclosure is presented in a way that best represents the registrant’s historical pay-for-performance practices.