Taskforce on Nature-Related Financial Disclosures Publishes Final Framework for Reporting on Nature-Related Issues

On September 18, 2023, the Taskforce on Nature-related Financial Disclosures (“TNFD”) published its final framework for voluntary nature-related disclosures (the “TNFD Recommendations”). The framework, which takes its inspiration from the Taskforce on Climate-related Financial Disclosures (“TCFD”), represents a significant step toward the coalescence of nature-related disclosure standards for corporates and financial institutions and has the potential to influence investor expectations and/or future regulation.

In this Alert, we briefly recap the structure of the TNFD framework, discuss key changes and enhancements in the finalized TNFD framework relative to the prototype, and consider next steps for TNFD and nature-related reporting.

Overview of TNFD Framework

The finalized TNFD framework is largely aligned with the prototype’s structure, setting out:

- Foundations for an understanding of nature and business, including a business’s dependencies and impacts on nature1 that give rise to nature-related risks and opportunities;

- Recommendations and guidance, which include conceptual foundations of nature-related disclosures, general requirements for the preparation of disclosures and a set of 14 recommended disclosures (aligned with TCFD-recommended disclosures, plus three additional unique recommendations) for all sectors to be provided alongside financial statements; and

- A metrics architecture.

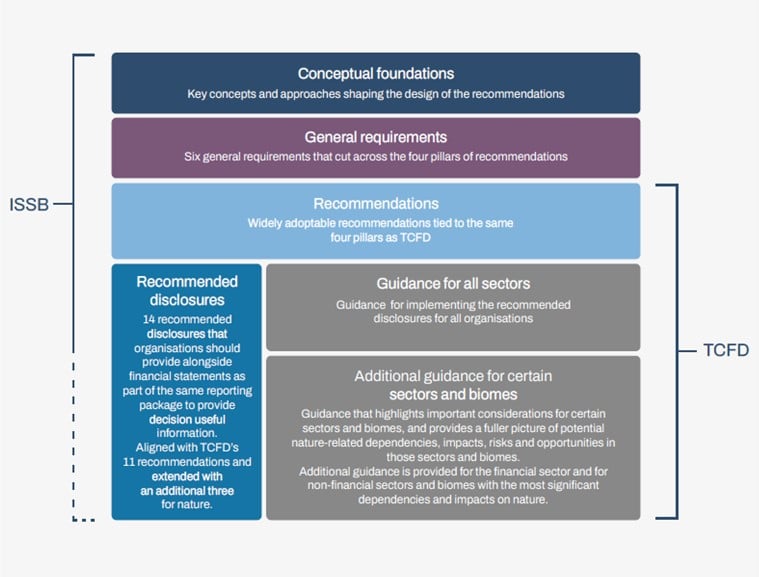

The recommended disclosures are designed to be interoperable with the recently published disclosure standards of the International Sustainability Standards Board (“ISSB”) and are structured around the four pillars of the TCFD: governance; strategy; risk and impact management; and metrics and targets (See Figure 1). The TNFD framework has been developed with the aim of ensuring consistency with the TCFD recommendations in language, structure and approach in order to support the integration of nature-related and climate-related reporting, and build on market experience with climate-related reporting to date.

Figure 1: Architecture of the TNFD and Alignment with ISSB and TCFD2

While the TNFD’s recommended disclosures are primarily process descriptions, most organizations will likely need to collect new information across their business models and value chains to be able to adopt all of the TNFD Recommendations.

Updates to Disclosure Under the Final Framework

The final framework includes a number of key updates as compared to the prototype framework. Among these are a reframing of six general requirements that apply across the four pillars of the recommended disclosures, covering:

- The application of materiality: the TNFD framework acknowledges that different approaches may be taken to materiality. Reporters are instructed to use their jurisdiction’s regulatory approach to materiality. In the absence of applicable regulatory guidance, the TNFD suggests that organizations apply the ISSB’s approach to identifying material information as a baseline for general purpose financial reports and that organizations consider applying an impact materiality definition aligned with the Global Reporting Initiative (“GRI”) should they choose or need to do so. This interoperability of the TNFD framework with other international standards and reporting frameworks is a key facet of the finalized framework and is discussed in greater depth below;

- The scope of disclosures: which asks for organizations to describe the scope of nature-related assessments and disclosures and the process for determining that scope;

- The location of nature-related issues: noting that, whereas climate change is a global process, nature-related impacts and dependencies are location-specific and therefore require local, context-specific assessment and responses;

- Integration with other sustainability-related disclosures: in particular, the integration of climate-related and nature-related disclosures given the nexus between climate and nature issues;

- The time horizons considered: relevant short-, medium- and long-term time horizons, noting that nature-related risks and opportunities may manifest over the longer term; and

- The engagement of Indigenous Peoples, local communities and affected stakeholders in the identification and assessment of nature-related issues: stressing that effective and meaningful engagement with these groups is important given their unique knowledge and given “Indigenous Peoples are stewards of approximately 80% of the world’s remaining biodiversity.”3

The TNFD includes analogs to all 11 TCFD-recommended disclosures. However, unlike the TCFD framework, the TNFD framework focuses on disclosure regarding not only risks and opportunities but also nature-related impacts and dependencies. The TFND framework also includes three additional recommended disclosures regarding (i) organizations’ human rights policies and engagement activities, and oversight by the board with respect to Indigenous Peoples in the assessment of nature-related dependencies, impacts, risks and opportunities, (ii) material4 and sensitive5 locations (referred to as “priority locations”) of assets and/or activities affected by, or interfacing with, nature, and (iii) organizations’ processes for identifying, assessing and prioritizing nature-related dependencies, impacts, risks and opportunities in their upstream and downstream value chains.

Metrics and Targets

The TNFD’s final framework provides significantly more detail than the prototype regarding the metrics and targets to use to assess and manage material nature-related dependencies, impacts, risks and opportunities, including two annexes with “core”6 and “additional”7 global disclosure metrics.8

Organizations are encouraged to report against all of the “core” metrics (on a “comply or explain” basis9), which notably refer to the metrics included in the ISSB’s Climate-related Disclosures Standard, and any relevant “additional” metrics. Where possible, this reporting should cover financial information about the effects of nature-related risks and opportunities on the organization, and how the organization monitors and manages these effects.

The TNFD also encourages disclosure of organizations’ targets and goals for the management of nature-related dependencies, impacts, risks and opportunities — as well as performance against these targets and goals.10 The TNFD recommends that organizations use the Science Based Targets Network’s resources for nature-related target setting.

Sector- and Biome-Specific Guidance

Draft sector-specific guidance has been published for financial institutions to support these organizations in the application of the TNFD Recommendations. This draft guidance provides additional detail on the recommended disclosures for these entities, including, for example, how nature-related risks and opportunities are considered in investment selection, and their processes for identifying, assessing and monitoring nature-related risks in their portfolios. The TNFD is seeking feedback on this draft guidance before it is released in final form in 2024, particularly in respect of the proposed disclosure metrics for financial institutions.

Separately, to support corporates operating in specific land, freshwater and ocean biomes, the TNFD has developed guidance on the application of the four-stage “LEAP” approach to the assessment of nature-related risks and opportunities in these ecosystems, recognizing the location-specific characteristics of nature-related dependencies and impacts in these environments.

Looking Ahead

The TNFD’s Recommendations have thus far been welcomed by multiple global standard-setters including the UN Principles for Responsible Investing (PRI), Financial Stability Board (FSB) and International Organization of Securities Commissions (IOSCO). The TNFD’s alignment with other disclosure standards may encourage both the market’s uptake of the TNFD Recommendations and the general convergence of nature-related disclosure standards. The ISSB has stated that it will consider the TNFD framework as it develops additional topic-specific sustainability-related disclosure standards, and the influential environmental reporting platform CDP has announced its intention to align with the TNFD framework. Further, with respect to the disclosure of impact-related information, the TNFD Recommendations are designed for consistency with the European Sustainability Reporting Standards,11 which expressly incorporated the LEAP approach, and the GRI’s widely used voluntary reporting standards.12 Because of these complementary features, organizations seeking to begin reporting in line with the TNFD Recommendations may be able to leverage existing sustainability reporting practices as a launching point for their nature-related disclosures.13 A number of companies have already indicated they intend to publish TNFD-aligned disclosures.14

Similar to the trajectory of the TCFD, the TNFD Recommendations may also become part of certain investors’ expectations and ultimately influence regulatory requirements. Approximately one week after the release of the TNFD’s final framework, Nature Action 100, an investor engagement initiative modeled on the Climate Action 100+ that seeks to drive corporate action and ambition to reverse biodiversity and nature loss, released its list of the 100 companies it will initially target for engagement. Notably, one of Nature Action 100’s six investor expectations is assessing and publicly disclosing nature-related dependencies, impacts, risks and opportunities. Ceres, which serves as the convener of the U.S. Consultative Group for TNFD and co-leads Nature Action 100, has noted that the Nature Action 100 investor expectations align with the TNFD Recommendations.

Additionally, the TNFD framework aspires to be a key instrument in nations’ efforts to achieve Target 15 of the Kunming-Montreal Global Biodiversity Framework (“GBF”), which encourages signatory governments to ensure that large and transnational companies and financial institutions regularly monitor, assess and disclose biodiversity dependencies, impacts and risks. The TNFD’s focus on ensuring consistency between its framework and the GBF’s targets and policy goals may, along with evolving market practice and investor pressure, ultimately facilitate regulators’ adoption of the TNFD Recommendations into mandatory reporting regimes.

Whether mandatory or voluntary, greater nature-related disclosure could engender opportunities in nature-related investment, with one market survey indicating that a majority of institutional investors view nature as a distinct asset class, suggesting interest in identifying potential for nature as a future investment theme. Indeed, several private investment fund sponsors have recently launched natural capital strategies.15

As the market and regulatory landscapes evolve, the TNFD plans to continue refining its recommendations and guidance, with future development priorities including (i) additional sector- and biome-specific guidance, (ii) additional nature-related metrics (including those specific to financial institutions), (iii) availability and quality of data and analytics tools, and (iv) greater alignment with international frameworks and reporting initiatives.

Although nature-related disclosures remain a nascent and evolving space, the TNFD Recommendations represent a significant milestone in the expansion and standardization of sustainability-related reporting, and it remains to be seen whether they will parallel the gradual voluntary and regulatory uptake trajectory pioneered by the TCFD.

1. The TNFD’s finalized framework refers to the same “four realms” of nature set out in the prototype: land, ocean, freshwater and atmosphere. ↩

2. TNFD Recommendations at 40. ↩

3. TNFD Recommendations at 45. ↩

4. Locations where an organization has identified material nature-related dependencies, impacts, risks and opportunities in its direct operations and upstream and downstream value chain(s). ↩

5. Locations where the assets and/or activities in an organization’s direct operations — and, where possible, upstream and downstream value chain(s) — interface with nature in certain enumerated types of areas. ↩

6. TNFD Recommendations at 81. The core metrics relate to indicators such as the extent of land/freshwater/ocean-use change by type of ecosystem and business activity, pollutants released to soil, volume of water discharged, hazardous and non-hazardous waste generated, plastic footprint, non-GHG air pollutants, water withdrawal and consumption, and quantity of high-risk natural commodities sourced from land/ocean/freshwater. ↩

7. TNFD Recommendations at 89. The additional metrics relate to indicators such as land-use intensity; volume of wastewater treated, reused or recycled; reduction in waste generated; volume of pollutants removed from land, atmosphere, ocean and freshwater; water replenished to the environment; water loss mitigated; and quantity of wild species extracted from natural habitats for commercial purposes. ↩

8. The absence of a universally agreed global architecture for measurement and reporting for nature, comparable to what the Greenhouse Gas Protocol represents for climate disclosure, presented TNFD with a significant challenge in making recommendations regarding metrics and targets. ↩

9. With an explanation for any metrics omitted on the basis that the metric is not relevant, not material, or cannot be measured. ↩

10. TNFD recommends that targets be specific, time-bound, and capable of measurement, and that performance should be contextualized with a historical analysis against previous years. Where targets are exceeded or missed, reporting organizations should explain the reasons why (including any adjustment or resetting of targets). ↩

11. The European Sustainability Reporting Standards, which consider nature a “silent stakeholder”, expressly incorporate the LEAP approach into materiality assessment requirements for pollution, water and marine resources, and material resource use and circular economy. Use of the TNFD Recommendations can also support due diligence obligations under new and emerging European regimes, including the “Deforestation-free Products Regulation” and the proposed Corporate Sustainability Due Diligence Directive. ↩

12. For example, the TNFD’s recommended metrics were designed to align with applicable GRI standards and, with respect to impact materiality, the TNFD aligned its recommendations (and supporting additional guidance) with the language and approach of GRI. ↩

13. The TNFD notes that over 86% of respondents to a survey of the TNFD Forum indicated they felt they could start reporting on the TNFD recommended disclosures by calendar year 2026 (based on FY 2025). ↩

14. An inaugural list of TNFD adopters is expected to be released at the World Economic Forum in January 2024. ↩

15. E.g., Climate Asset Management. ↩